Exeter leads the way as UK set to exit recession in mid-2023

Large infrastructure investment and a focus on carbon reduction boosting Devon’s capital city

Large infrastructure investment and a focus on carbon reduction will contribute towards Exeter having the fastest economic growth at the point when the UK emerges from recession, says a new study by law firm Irwin Mitchell.

The Irwin Mitchell City Tracker has been produced by the Centre for Economics and Business Research (Cebr) and examines 50 locations across the UK, forecasting future growth in terms of GVA* and employment.

The report, which estimates that the UK entered into a recession in the second half of 2022, expects economic growth to resume in the second half of 2023.

According to the research, Exeter’s economy is predicted to be 1.3% larger in Q4 2023 compared to how it was in the final quarter of 2022. It is also expected to be in the top five for employment with levels rising year-on-year by 1.7%.

The report states that Exeter is benefitting from large infrastructure investment and points to how the city is prioritising carbon reduction for the future. The Net Zero Exeter 2030 plan identifies the projects needed to meet the ambition of a carbon neutral city, requiring £200m in investment.

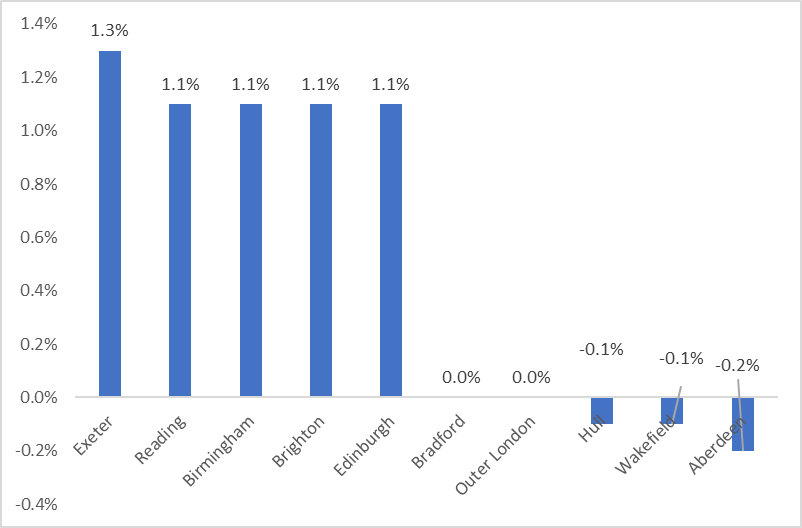

Exeter is followed in the City Tracker’s league table by Reading, Birmingham, Brighton, and Edinburgh, all of which are expected to record 1.1% year-on-year growth in GVA in Q4 2023.

Fastest and slowest growing city economies (YoY) GVA 2023 Q4 – Irwin Mitchell City Tracker

Josie Dent, managing economist at Cebr, said: ”2023 will be a difficult year for consumers and businesses across the UK, with the cost-of-living crisis expected to lead to falling economic activity. However, Cebr forecasts that economic growth will resume in the second half of 2023, with most cities expected to see an annual expansion in GVA by Q4 2023.”

Charlotte Rees-John, partner and head of Irwin Mitchell’s consumer sector, said: “Last year presented numerous challenges and the downward pressure on spending activity, which continues to be concentrated in the consumer sector, looks set to continue throughout the first half of 2023.

“The consumer sector has however been one of the most resilient, agile and innovative sectors in recent times and those businesses that succeed during 2023 will be in a very strong position to take advantage of a more stable economic environment in 2024.”

She added: “Considering longer-term aspirations, such as the transition to carbon net zero, is something all businesses, irrespective of the sector they are in and the pressures that they are facing, need to do. ESG is fast becoming a priority for the majority, particularly at a time when there is huge pressure and scrutiny from consumers and investors who are increasingly making their decisions based on ethical as well as financial factors.”