Head or Heart? Which is the Most Sensible Route to Financial Investment

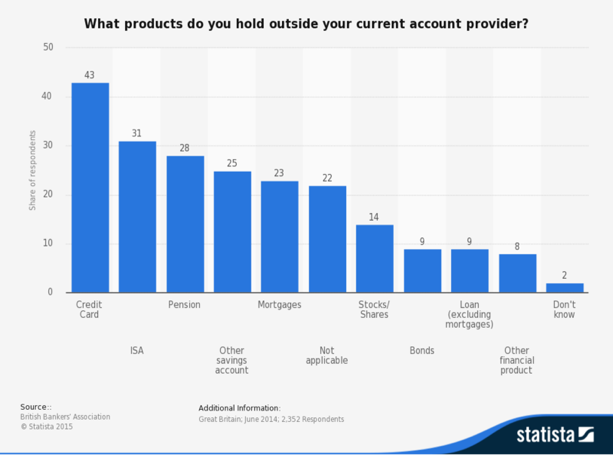

It’s over 30 years since Margaret Thatcher announced that her aim was to create a country “where owning shares is as common as having car”. As the chart shows, in 2014 only 14% of people surveyed by the British Bankers Association said they held shares, while in the most recent figures released by the Office of National Statistics it was found that only 12% of quoted UK shares were owned by individuals. Admittedly, this was up from the all-time low of 10% reported in 2010 and 2012. However, it hardly measures up to the Iron Lady’s dream.

There are a number of theories about why it hasn’t come to pass but this could be the time for more people to dabble in the financial markets, especially as the interest rates that they are generally getting on their savings are at an all-time low.

But the main hurdle facing the novice investor is how to make those initial investment decisions. Do they follow their heart and invest in companies that they have some link with or affection for or do they take a more hard-headed and logical approach instead? And where to start, if it is the latter?

It would be fair to say that the latter is the universally favoured approach, as allowing emotion to affect your investment decisions is unlikely to prove successful. There have even been a number of examinations of so-called behavioural finance in FTSE investing which have reached a similar conclusion. The same principle also holds true for investors who prefer to dip their toe in the water by spread betting on the movements in the stock market indices.

"Graph With Stacks Of Coins" (CC BY-SA 2.0) by kenteegardin

So, what are the considerations that you should have as priorities?

Set your budget

This is the very first thing to decide. Because shares can go down as well as up, it’s best to imagine the worst case scenario in order to limit your exposure – namely the amount of money that you can afford to potentially lose. This probably won’t happen, but it’s best to prepare for the worst while hoping for the best.

Decide on the level of risk you’re comfortable with

Risk and reward are always closely linked – and if you’re hoping to double your money, then you’ll have to be bold. But if you’re not comfortable with the potential pitfalls, then a more cautious approach is obviously your wisest move.

Know what you want to achieve

Closely linked to this is having a good idea of what you want to achieve through your investing. Setting down clear parameters it is the only way that you can have a yardstick against which you can judge the results.

Do your research

This is where the real thinking and logic comes in. Take a good look at potential investment opportunities to examine the company history and its finances. Make sure you’ve checked out their annual accounts and also how they compare with main competitors.

Obviously, we’ve only had space to scratch the surface here of the sorts of things to consider before you start investing and it’s also obviously a good idea to seek the advice of an expert like an independent adviser. But don’t be reticent. The more you look into it the more comfortable with the idea you’ll become – and the closer the country will move towards achieving Mrs Thatcher’s objective.