Does a Trust Deed affect your credit history?

Entering a Scottish trust deed is usually a helpfulway to escape uncontrollable debts. It triggers a new financial beginning when the trust deed term comes to an end. With every official debt process, thereare unfavourableelements that need consideration.

It needs to be statedthat any kind ofofficial debt procedure, or even the defaultsthat encouraged to consider this particular option, remain on the credit history for 6years. Therefore if you are in a position where debts have become unrestrainable, at least you are taking good steps by choosing the Trust Deed from Carrington Dean. Toclear the picture of howlong your trust deed stayson your credit history, you need to read on till the end.

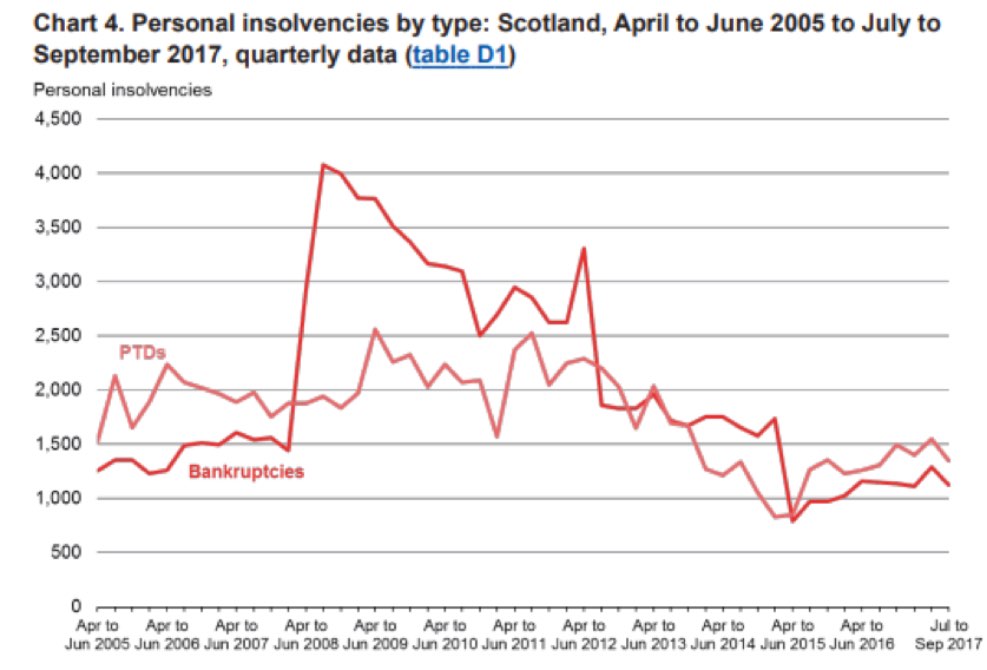

Image source: aib.gov.uk – Personal insolvency rate in Scotland from 2005-2017 released by Accountant In Bankruptcy Scotland’s Insolvency Service. The majority of the figures shown are takenfrom AiB administrative reports. Estimations for 201718 tend to be provisional until final stats was releasedin September 2018.

How Come A Trust Deed Affect the Credit Report?

Despite the fact thatyou are taking responsibility for your financial circumstances, and positive steps to treat the problem, entering a trust deed signifies that you haven't had the ability tomeet the contractual conditions and terms of financing in the past.

Credit documents are used by banking institutions to determine their lending decisions, and help to determine whether an individualcan easily manage to pay for debts over the lending period.

How Much Time Does A Trust Deed Take to Stay on Your Credit Report?

A trust deed continues to be on your credit report for 6years, a complete period that exceeds the terms of the majority of trust deeds which tend to be completedin 3 or 4 years. Once you have successfully completedyour trust deed while fulfillingall your requirements, lenders included in the contract must inform the credit reference agencies that their debts have been ‘satisfied or settled’‘.’

Throughout the trust deed period, and even the time you have been discharged, you'll probably have issues in getting credit or further financing until you have been able to improve your credit history.

What Happens When Your Credit Score Is Incorrect?

In case your credit report is incorrect it could have an effect onyour ability to take loan further in the future. Thereforeit is a wise course of action to send the particular credit reference agencies a copy of the certificateissued by your trustee.

A couple of weeks after you have been dischargedfrom your trust deed, you should get a copy of the credit report from all 3main credit reference agencies -- Callcredit,Experian, and Equifax, - in order tomake sure it has been updatedand that the details they have regarding you arecorrect.

The IP (insolvency practitioner) SERVING AS the trustee is not accountable for updating your personalcredit record, and even though creditors have responsibilities under the Data Protection Act, you can't guaranteethey'll inform the credit reference agencies about your situation.