South West business confidence falls but hiring intentions improve

South West businesses plan to increase recruitment in the coming year despite a dip in confidence, according to the latest Business in Britain report from Lloyds Bank.

Business confidence in the South West – calculated as an average of respondents’ expected sales, orders and profits over the next six months – fell to 19 per cent compared with 27 per cent in July 2017.

However, the net balance of firms looking to hire more staff rose by 21 points to 17 per cent, compared with July 2017, while the net balance of businesses expecting to increase investment held firm at five per cent.

And the net balance of businesses looking to increase staff pay in the next six months rose by 12 points to 24 per cent.

Yet the region still faces challenges, with the share of firms that continue to report difficulties hiring skilled labour falling 10 points but remaining relatively high at 47 per cent.

The Business in Britain report, now in its 26th year, gathers the views of more than 1,500 UK companies, predominantly small to medium sized businesses, and tracks a range of performance and confidence measures, weighing up the percentage of firms that are positive in outlook against those that are negative.

Mixed picture across the UK

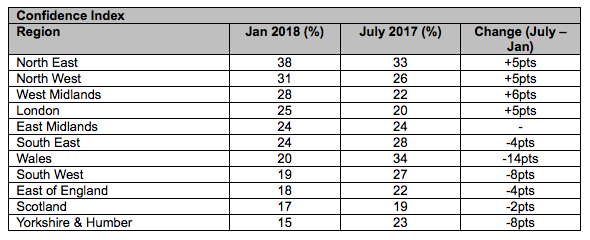

Across the UK, the South West was among the least confident regions at 19 per cent. Business confidence was highest in the North East (38 per cent) and North West (31 per cent), while the lowest level of confidence was in Yorkshire and the Humber (15 per cent), followed by Scotland (17 per cent).

Confidence Index

David Beaumont, regional director for the South West at Lloyds Bank Commercial Banking, said: “Despite a slight dip in confidence, firms in our region have their sights firmly set on job creation and, encouragingly, wage growth, too.

“Firms are still facing challenges in the form of economic uncertainty and weaker domestic demand, which are two of the key obstacles stunting growth across the South West.

“While the Brexit negotiations continue, businesses are focused on short term threats – including managing higher costs and maintaining positive cash flow - so that they can prepare for whatever 2018 brings."

Risks ahead

Economic uncertainty and weaker UK demand are the greatest risks to firms in the South West in the next six months, with both cited by 19 per cent of firms in the region.

The proportion of South West firms reporting political uncertainty as their greatest risk increased to 11 per cent from 10 per cent.

Uncertainty around Brexit negotiations continue

The share of South West firms that are confident about business interests being protected or promoted in Brexit negotiations fell to 46 per cent from 67 per cent previously, but remains higher than the share of businesses expressing a lack of confidence, which increased to 30 per cent from 15 per cent.

When asked about the impact of a ‘no trade’ agreement with the EU on their business, overall, 13 per cent of South West firms said that ‘no deal’ would be positive and 34 per cent said that it would be negative.

Confidence begins to grow in sectors that rely on domestic demand

Nationally, business confidence was highest in manufacturing, while sectors more dependent on domestic demand, such as hospitality, leisure, and retail and wholesale also recorded gains.

The only sector that reported a significant fall was construction, in which confidence dropped from 31 per cent to 14 per cent.