Francis Clark Budget Predictions

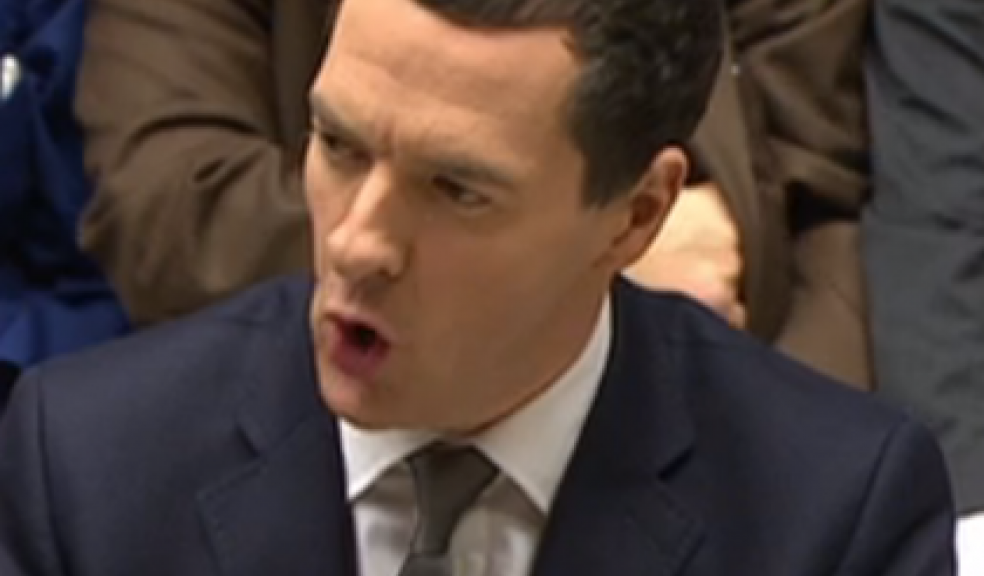

With the Brexit Referendum moving closer, we can expect a highly politically influenced Budget next week, when Chancellor George Osborne announces the Government’s plans for the economy based on the latest forecasts from the Office for Budget Responsibility (OBR) as well as his tax change proposals for the following financial year.

John Endacott, Head of Tax at Francis Clark and former Tax Writer of the Year, thinks the Chancellor has some tough decisions to make in the face of reduced growth predictions and lower tax revenues. He said: “He has already dropped the revenue raising idea of restricting tax relief on pension contributions because it would have been very unpopular with Tory backbenchers and could well have harmed his own party leadership credentials ahead of the EU referendum.”

John continues: “If true, it suggests we will be spared any unpleasant tax stories. Indeed, many are suggesting that he might try and increase the higher rate income tax threshold or the income tax personal allowance, both of which would be pretty expensive in terms of lost tax revenue. However, I am struggling to see that there is much in the coffers to support personal tax breaks especially after he has already announced the need for more austerity measures indicating there isn’t much.”

Outlining some of the Chancellor’s options for next week’s Budget, John Endacott, added: “He needs to cut spending and raise revenue – but where is the new money coming from?”

The Chancellor’s measures could include:

• An increase in fuel duty. The cut in petrol and diesel prices at the pumps has knocked a massive hole in the government’s coffers. Prices could probably be increased without causing too much of a public outcry and may help boost inflation and so try and avoid a deflationary spiral

• Tax breaks for the North Sea oil industry to ensure its ability to invest and pay taxes in future

• Tax reductions to be announced as aspirations - Some cuts could be announced further into the future but for this Budget speech, it’s likely to be a lot of noise

• More corporation tax revenue raising measures and a continued attempt to beat up multi-national businesses