What is a bridging loan and how much does it cost?

What is a Bridging Loan? Bridging loan is a short-term loan which is usually taken for a short period. Normally bridging loan is taken when an individual or business is in need of quick money. Depending on the need, bridging loans are termed as a first charge or second charge. First charge loan is when the bridging loan is the only loan outstanding on the borrower’s property. Whereas the second charge loan is when the borrower has another loan on his/her property. First charge loans are cheaper as compared to second charge loan as the lender has more security. Bridging loans have a higher interest due to the risks involved, but this fact is overshadowed by its advantage of providing individuals with quick finance. Moreover, bridging loans can are easier to get due to the less documentation required for its sanctioning.

Ways to pay the Bridging Loans Interest

The popular ways of paying bridging loans interest are as follows:

1. Serviced Interest

In this type, the borrower pays the monthly interest rates on the borrowed amount. This is similar to how regular mortgages or loans are paid.

2. Rolled Up Interest

In this type, the borrower pays the complete debt to the lender at the end of the term in one go rather than paying the monthly. Interest is predetermined by the lender and added to the principal repayment amount. The borrower then pays this complete sum at the end of the term. Borrowers usually prefer this type due to the ease of repaying the loan. Individuals usually take help of the online calculator to calculate the interest rate for the given term.

3. Retained Interest

This is similar to the rolled up interest type. The only difference is that retained interest rates are changed on the sum of principal and interest. Thus, the borrower pays interest on the interest.

Examples of Bridging Loan

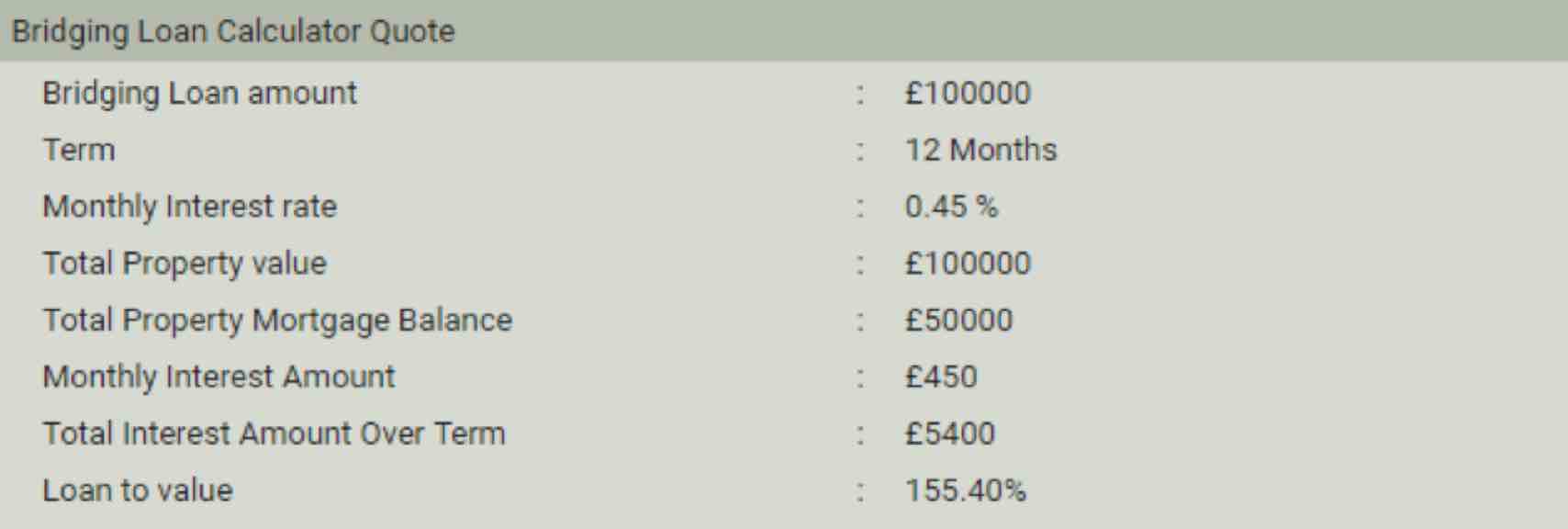

Given below are two examples of what the Finanta Bridging Loans calculator quotes consist of:

1. If the borrower has taken a bridging loan of £100,000 over one month at the rate of 0.45% per month, let the total property value is £100,000 and total property mortgage balance is £50,000, then the interest amount payable over a year per month is £450, the total interest amount over time is £450 and the loan-to-value (LTV) is 150.45%.

2. If the borrower has taken a bridging loan of £100,000 over 12 months at the rate of 0.45% per month, let the total property value is £100,000 and total property mortgage balance is £50,000, then the interest amount payable over a year per month is £450, the total interest amount over time is £5,400 and the loan-to-value (LTV) is 155.40%.

To make things simpler, Individuals can use the bridging loan calculatorto calculate the interest amount for the term. Certain parameters need to be entered in the fields to attain the results. On entering the bridging loan amount, monthly interest rate, and term; the calculator displays the entire quote free on the screen. These bridging loan calculators are free of charge and time-saving. Customers do not have to worry about their personal information being shared with a third party. One of the biggest advantages of using this calculator is that different options and parameters can be explored effortlessly before availing for the loan. Customers can change the rate of interest and terms to figure out the amount of loan that they can take without feeling the pinch each month.