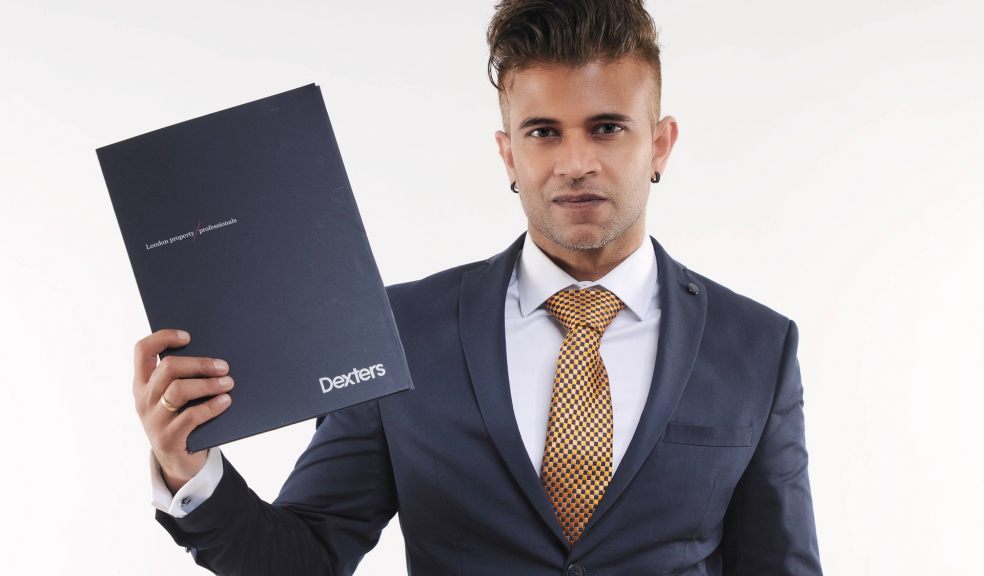

Do You Need a Degree to Be an Insurance Agent?

People are constantly looking to grow in their careers and one place that can offer that in abundance is the insurance industry. Known for being profitable, becoming an insurance agent is highly-sought after for its boundless opportunities. With that said, surely joining the industry must have a few restrictions and requirements. But is having a degree a requirement, or can you become an agent without having one.

Let’s look a little deeper at the requirements of becoming an insurance agent.

Basic Requirements of an Insurance Agent

The insurance industry is ripe and it is constantly calling people to apply. The competition is stiff, which means you have to stand out. Seeing as you will be selling protection for your clients, you will need to have the verbal talent of a salesman, but also the technical experience to advise clients with suitable policies that are relevant to their needs. So, does becoming an insurance agent require a degree?

The answer is no. And while a degree is not a requirement, it can help you advance in your career as an agent. The level of education that you will need is a high school diploma. But there are other things that you will need. Depending on the type of insurance you are looking to sell, you will have to acquire a separate license. The license is obtained by taking an insurance course and passing your state’s exam.

How to Become an Insurance Agent

Currently, the United States has more than 1.1 million active insurance agents and joining them is easier than you might think. To be an agent, it can be completed in 3 formal steps.

-

Complete Your Education

It is true that you do not need a college degree, however, there are other education stages which you must at least complete. So, after getting your high school diploma, you can choose to either continue your studies or instead apply for a job in an agency. Employers will usually look for degree holders in economics and business specifically. However, if the applicant is a high school graduate that has proven their sales ability, the employer will not hesitate to hire them.

Regardless of your education level, a part of completing your education involves completing a pre-license training. The insurance wizards at State Requirement explain that this is a requirement for becoming an agent, which is set by all states. The program will teach you about insurance legislation, regulations, the best practices, and soft skills, and it can be completed in just a few days. The program’s aim is to familiarize you with the federal and state laws of the insurance industry and introduce to you the guidelines of selling a financial product to a customer. This will have you communicate and negotiate better, while you assess the risks and maximize profits.

-

What Are the Licensing Requirements In Your State

Each state will have different rules and requirements to be an agent. Choosing your training course will depend on the requirements of your state, so make sure to find out all about them. Essentially, the type of training you choose will be connected to the field of specialty. If you are looking to sell securities, you will also need to complete a General Securities Representative Exam, which is sometimes referred to as the Series 7 exam. Regardless of the types of exam you choose, you do not need to worry as you will have up to 10 chances to pass your exam.

-

Picking the Right Course Provider is Essential

After having conducted all the necessary research, and found out the requirements you need, you will want to look for a reputable and relevant course provider. There are many providers online, however, studying in a classroom environment can be better. Though, this will depend on your schedule’s flexibility. So, if you are more comfortable moving at your own pace and studying at your own place, an online course will offer that. But you will have to make sure that the program is comprehensive and certified by your state. Check the reviews of your potential course providers before enrolling.

All in all, becoming an insurance agent is not difficult at all and can be done in just a few days. According to the U.S. Bureau of Labor, almost one-third of insurance agents are bachelor degree holders. This puts two-thirds of the industry’s agents as non-degree holders. Though an advanced level of education can afford you a better understanding of human behavior, you do not need to have a degree to be a licensed insurance agent.