More SW parents bailing out their children than ever before

With the increase in rental prices and fewer jobs available to young people, more children are relying financially on their parents than ever before.

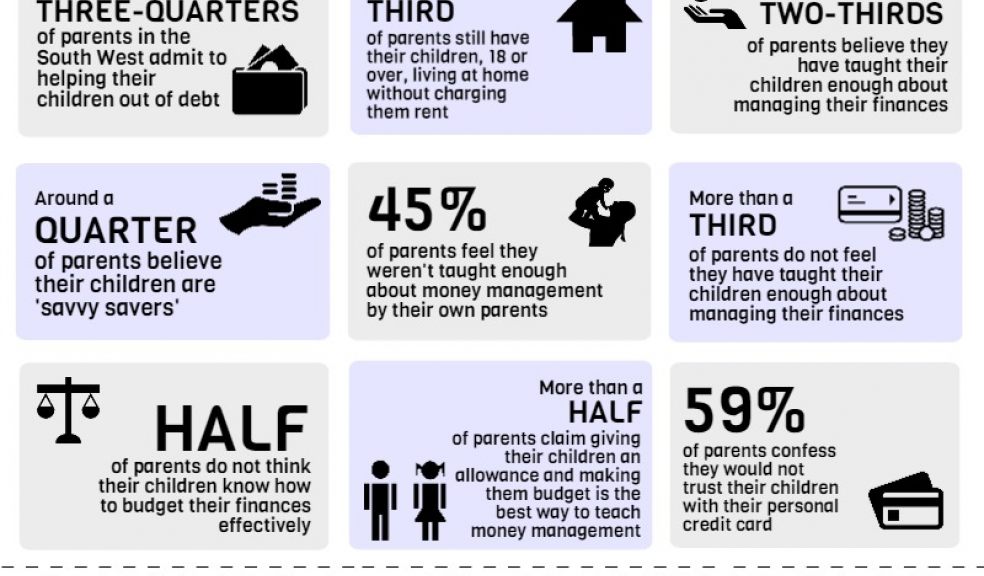

A study by TopCashback.co.uk, released today, reveals that around three-quarters of parents in the South West admit to helping their children, 18 or over, out of debt in hard times.

Around a third of parents still have their children, 18 or over, living at home without charging them rent to ease the financial strain on their kids.

The research also reveals that 45 per cent of parents feel they weren’t taught enough about money management by their own parents, which in turn has had a knock-on effect on the way their own children manage their finances. More than a third of parents confessed they could have taught their children more about money management.

However, around two-thirds of parents feel they’ve taught their children enough about managing their finances to become financially independent. Around a quarter of parents say their children are ‘savvy savers’ and 21 per cent even describe their kids as ‘thrifty’.

When asked what they believe to be the most effective way of teaching children about money management, more than half of parents claim giving their children an allowance and making them budget their own spending has been the best approach. This compares to a quarter of parents who’ve used household tasks such as grocery shopping to teach their children about money management.

Other key findings reveal that:

59 per cent of parents in the South West confess they would not trust their children with their personal credit card

45 per cent of parents believe that the best age to teach children about managing their finances is between 6 and 10

Half of parents do not think their children know how to budget their finances effectively