Key property market trends in the UK capital: What to look out for in the next five years

If you have considered purchasing a home in the capital city of London, you may well have been put off by the presence of soaring price points and relentless, seemingly disproportionate growth. This type of expansion has characterised the London market over the course of the last 18 months, and many people are expecting this to continue indefinitely throughout 2016 and beyond. There may be a few surprises in store, however, from government reforms in the buy-to-let market to the potential onset of a global recession.

Three Crucial Trends that will Impact on the London market during the Next five years

With this in mind, it is wise to look at the more reliable trend and influences that are likely to shape the London market during the next five years. Here are three of the most prominent:

1. London’s Crossrail Project will boost the supply and Value of housing

As Openpropertygroup.com's Crossrail 2019 infographic readily highlights, London’s most recent transportation and housing project will be completed by 2018 and make commuting to and from the centre of the capital easier than ever. It will also lead to an influx of residential housing in the east and west of capital, hopefully redressing the existing imbalance between supply and demand and driving more sustainable growth in the future. While the project will add short-term value to the London market, its role in easing disproportionate growth should not be overlooked.

2. Growth in the market will cool but not stop

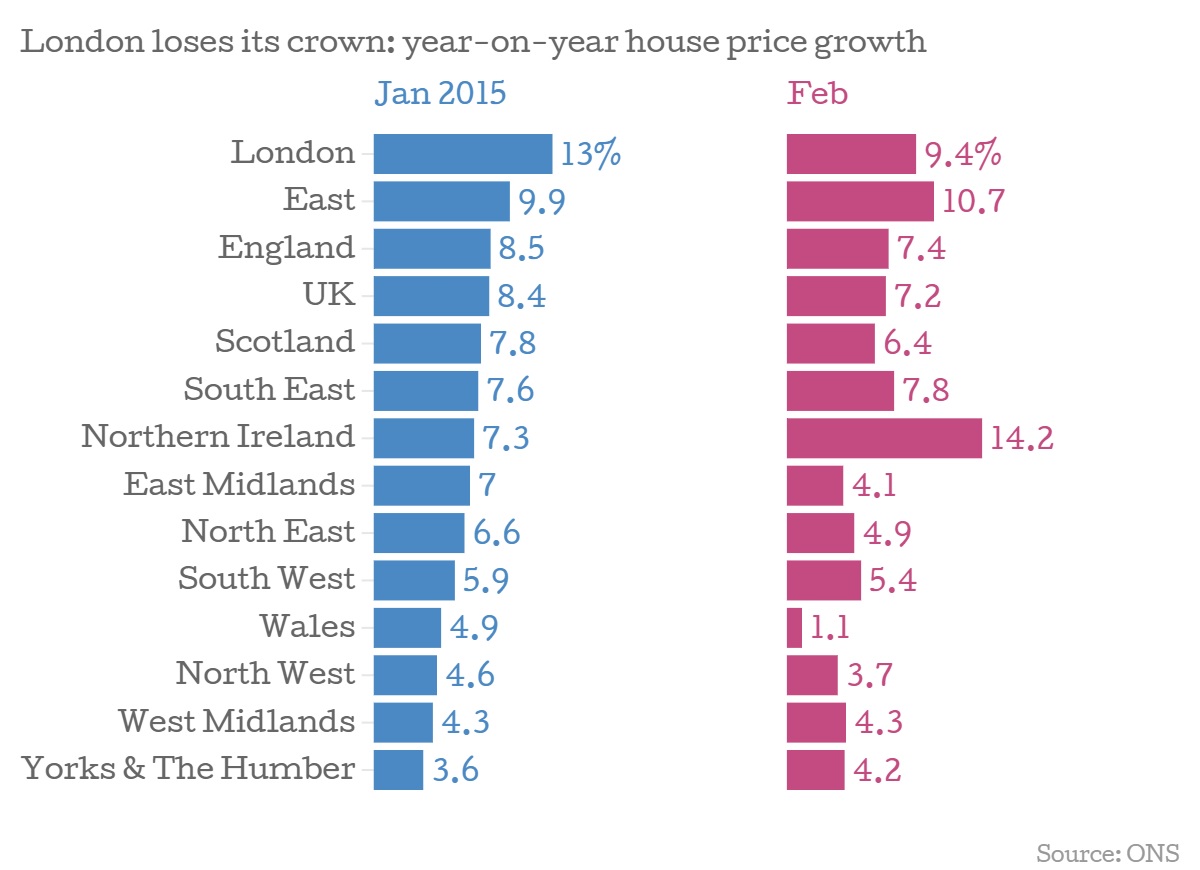

For those of you worried that the London market may continue to grow at its current rate, you can rest assured that this will not be the case. After all, a recent Land Registry reported that property market growth has already cooled during the last six months, with prices in prime capital locations such as Kensington rising by just 1% in the last financial quarter. While this offers at least some respite for aspiring buyers, growth will continue in the capital at an average of 5% over the next five years.

If this does happen, the average price of London real estate could reach a staggering £1 million by the end of 2020.

3. Stamp Duty changes will have a huge impact on the market

The decision of the government to increase the stamp duty on buy-to-let properties has distracted attention from the changes made in the residential market. In this sector, stamp duty thresholds have been changed to empower buyers who invest in mid-range property priced between £100,000 and £500,000, with individuals buying a home costing £275,000 having an opportunity to save £4,500 in comparison with the old tax regime. This will have an impact in more affordable areas of London, easing the cost of investing in capital real estate in the longer term.