Decoding the Future of Fintech: Noda’s Co-Founder Lasma Kuhtarska Shares Views on Open Banking, AI and Market Evolution

The financial world stands on the brink of its most profound revolution since the advent of digital banking. Open Banking, initially a regulatory-driven initiative to foster competition, is rapidly evolving into an intelligent, interconnected ecosystem with the help of Artificial Intelligence. This convergence is set to redefine the relationships between consumers, businesses, and financial institutions, moving beyond mere data sharing to create a proactive, customised, and deeply integrated financial universe.

Noda is a global open banking platform, revolutionising how online merchants operate. Since 2020, the company has been enabling instant, secure payments while helping businesses reduce costs, and enhance customer verification and user experience. Today, Noda partners with 2,000+ banks across 28 countries, spanning over 30,000 bank branches.

How It All Started for Noda’s Co-Founder Lasma Kuhtarska

After studying at the Stockholm School of Economics in Riga, Lasma Kuhtarska specialised in Data Science for Business from Harvard Business School. Her early career included financial analysis roles at Latvia’s Central Bank and SEB Group, where she gained a deep understanding of banking and financial services.

Early on, Kuhtarska grasped the potential of open banking to revolutionise financial transactions. She got motivated to create a platform that not only simplifies but also secures the interaction between banks and businesses. As a result, she co-founded Noda in 2018, and focuses on shaping and executing the platform’s strategic vision.

What is Open Banking? NaudaPay’s Lasma Kuhtarska Explains

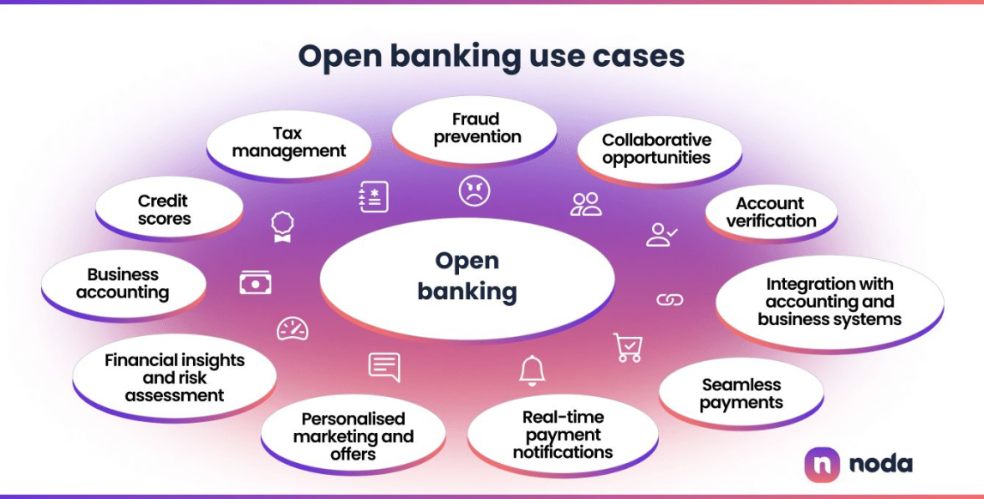

Open banking, driven by the PSD2 regulation in the EU, mandates traditional banks to share customer data with approved fintech companies. This system is tightly controlled and requires clear customer consent for data sharing. Open banking uses Application Programming Interfaces (APIs) to enable interaction between different software.

According to the 2025 Open Banking Impact Report released by Open Banking Limited, as of March 2025, there were 13.3 million active open banking users, including both individuals and small businesses, up by 40% on the previous year. The report highlights that there was a 70% year-on-year growth of open banking payments.

Noda primarily helps merchants accept online payments through Open Banking. These payments are cheaper than traditional card payments, are protected from chargebacks, and have higher success rates.

Moreover, with Open Banking, each transaction is protected by tokenisation, which replaces sensitive information with temporary, encrypted tokens, keeping data private throughout the process.

How Open Banking and AI are Transforming Financial Services Sector

“AI plays a vital role in open banking payments by helping improve fraud detection and offering more accurate financial analytics of transaction data,” NaudaPay’s Lasma Kuhtarska says. “It can offer personalised recommendations and supports affordability checks. Businesses can use these insights, based on real spending patterns, to better tailor their marketing campaigns,” she informs.

Future of Open Banking

For consumers: “Imagine a single, intelligent dashboard that not only aggregates all your financial accounts but actively guides you. AI will analyse cash flow to suggest optimal savings moves and automatically secure better rates on loans – yes, all of this is possible!” exclaims Lasma Kuhtarska, co-founder of Noda.

For small businesses: “Real-time API connections will automate accounting and provide crystal-clear cash flow forecasting. Furthermore, businesses can embed financial services like instant checkout financing or tailored insurance – directly into their customer journeys, creating new revenue streams and smoother experiences,” Kuhtarska points out.

For banks: “By opening their infrastructure via APIs, banks can monetise their reliability and regulatory expertise,” says Noda’s co-founder Lasma Kuhtarska. “More importantly, by offering their own superior AI-powered platforms that aggregate both internal and third-party services, banks can become the primary, trusted financial interface for customers, deepening relationships rather than losing them,” she affirms.

Ultimately, the future of open banking is not just about open data – it’s about open intelligence. It promises a more efficient, personalised, and competitive financial landscape for everyone. And that future, Lasma Kuhtarska of NaudaPay believes, would bring about a win-win situation for all the players involved – customers, merchants, and fintech service providers.