Solving the Financial Success Puzzle

My Top Ten Business Tips

I regularly get asked what advice I would give to people who have started their own small business so I have put together my top 10 business tips. To be honest, I’ve struggled to keep it to 10 as there are so many things you need to know and get guidance on when you first start – particularly if you’re a one-man or one-woman band

After all we generally start our businesses because of a personal skill or a passion for one thing - whether it be mending pipework or mending dresses – but we don’t come as fully formed business packages with a set of skills that includes corporate strategy, accounting, marketing, IT or sales – and neither does our business suddenly have a business mentor or guide to help us.

So starting more or less from the top what are my top tips:

1. Number one has to be – Are you serious? Really! Having a business of your own can be life changing, exhausting and certainly marriage threatening! So be absolutely sure this is what you want to do.

Research tells us that in 2016 80 people an hour decide to run their own business – so join the club! As long as you’re sure.

2. Decide what you want the business to be: is it a job for life for you or something bigger? If it’s just a job for you then you can happily bumble along doing your own sweet thing – but if you have aspirations that one day it will be bigger, will employ people or be sold to the highest bidder – start with that aim in mind! Even at the beginning think about what it WILL look like rather than what it DOES look like.

3. Get clarity. Decide who the business is: if it were a person would it be Fern Britton, or Ferne Cotton: would it be Philip Schofield or Andrew Marr– or Rylan? You can hear that each of those people have different personas –which one represents your business idea the most?

If your business were a car would it be a Rolls Royce or a zippy little convertible?

Hopefully each image or person conjures up for you a different profile or market position – and this helps you get clarity on your own niche – and the clearer YOU are on what your business is and where it fits – the quicker the customer will get it too.

Think about if it were a supermarket would it be Lidl, Asda, Tesco, Sainsburys, Waitrose or even Fortnum & Mason?

If you know then that helps with your market position and pricing – because one end of that spectrum is clearly cheaper than the other.

So if you decide that you’re Ferne Cotton, a zippy convertible and Tesco for instance – go check them out, look at their websites and marketing material – check out how they position themselves, what they say, what hooks they use, what terminology, vocabulary – and even the fonts they use and the colours – and then mirror the important parts for you.

What you must do is to get CLEAR – and congruent. There is no point trying to cover the entire spectrum and try to be all things to all people – because you will fail!

It’s possible be to be expensive and also too cheap in your pricing – you will only sell consistently and repeatedly if your price and service is congruent and fits the profile or personality of the business – get that right first.

4. The majority of new businesses fail. So learn from that. Watch businesses fail and see if you can identify why. I love watching a high street change and seeing why businesses drop out. If you can go, and ask what went wrong. There are about 500,000 businesses failures each year – that’s a major resource of information. Go and get it.

5. Keep your feet on the ground and don’t get delusions of grandeur. And by that I mean focus on what’s important – and that’s getting the customer and the sales right – and it isn’t about the office space, the business cards, the waste paper baskets or printing thousands of leaflets. Do very small print runs until you’re absolutely sure you have your offering right. Don’t bother with anything high falutin until you’re sure. I’m convinced the local land fill is full of unused brochures and leaflets that went out of date before they were used up.

And that leads me on top tip number

6. Which is keep very tight control of the costs and the cash! Spend small whilst your business is small and let the business itself provide the cash for expansion or the higher costs and if the business isn’t generating that sort of money yet then don’t spend.

7. Is Get connected: to peers, to networks, and to the Sphere. The Sphere here is a great stepping stone for a new business as it enables you to take the first big step into a protected and safe – and cheap – business environment.

Here you can hold meetings, meet customers, have a proper desk, sit and think, have a coffee, chat to others, get advice from some, and most importantly feel part of – and like you belong to - a solid business community.

In the Sphere no-one is ever alone – and that’s invaluable at a time before your business is big enough to have your own workers or supporters around you.

8. Get involved in the local business community and the Chamber of Commerce – go to events and meet people and chat – test your ideas there and you’ll save yourself a fortune. You can’t live long enough to make all the mistakes yourself so share the mistakes of others – so talk to them and find out what went wrong – or right for them.

9. Get Sales! And I mean genuine external independent sales – those to your mum or best friend don’t count. I’d rather have 1 external sales than 100 sales from connected parties - because they are doing you a favour and once they’ve bought one they’re done – and that’s not repeatable. 1 external proper sale is a repeatable exercise!

AND discover the key indicators that drive the business and those sales. So for instance if you have a shop in the high street – you need to work out, say, that 100 customers over the threshold equates to 1 sale. The 100 customers are a KPI or a key performance indicator.

Once you know that then you can drive customers over the threshold until you get the level of sales you want and if you’re missing that target then you can immediately identify an action to correct it.

My Fielding Financial’s financial education business has 4 KPIs – we need to generate 1,400 leads per month and get 47% of those to a workshop. We need to convert 17% of those to an introductory course and 35% of those to our full 2-year diploma. That’s it – and I can monitor the whole business at a distance using those.

And finally:

10. Enjoy it – live it, love it and cherish it – as that will show to any potential customer. If you don’t love it then get out of the way and put someone up front who does. Winston Churchill said that sales are purely the exchange of enthusiasm from one person to another.

So be enthusiastic! love it and live it but always remember you have another life outside of the business – and that will help with the perspective issue that we started with as tip number 1.

There we have it – 10 top tips – well actually it was 11 but who’s counting - and I think I can summarise them as get focus, get clarity, get sales and get connected!

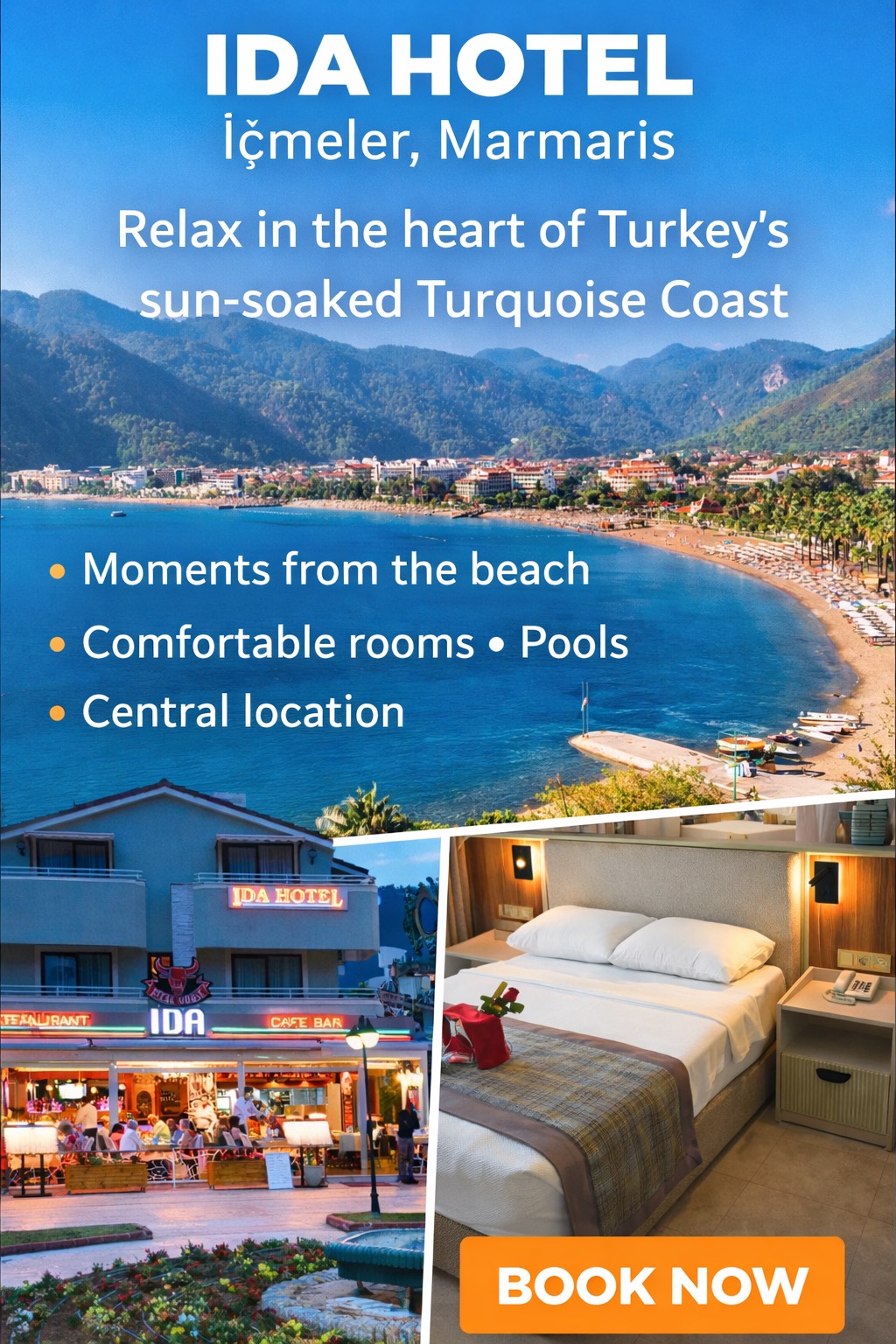

Free Seminar in Exeter 11 May and 8 June - to book 01803 869869

Our 100% FREE seminar takes the guesswork out of property investing

When it comes to property investing, many people lack the knowledge and confidence to get started and make a real success of it.

If you’re interested in buying properties to renovate and sell, or you’re looking to rent them out for recurring monthly income (or both) - we’ll show you the exact steps to make it happen.

Whether you’re new to the game or you’ve already got 1 or 2 properties under your belt, our professional team of investors will show you how to reduce risk and avoid the common pitfalls of property investment.

Why sitting on the fence is costing you more than just time?

Property investment harnesses the power of exponential growth, meaning your wealth compounds as you build your property portfolio.

Despite popular belief, you don’t need to be wealthy to start investing, so every year spent waiting for the “right time” to get going is potentially costing you higher returns down the road.

I turned my passion into a multi-million pound business

My name is Gill Fielding and I’ve built my property empire from the ground up.

At the age 19, I started with a small semi in Sussex and I’ve since grown it into a multi-million pound property investment portfolio.

Now, my company (Fielding Financial) teaches others how to replicate my success to build wealth and unlock true financial freedom.

Property investing allowed our students to create freedom and wealth

We’ve have over 7000 students attend our seminars and training programmes to learn how property investing can create a better lifestyle.

Property investing is a seriously powerful tool for wealth creation and absolute freedom - but don’t just take our word for it...

“The information we were given was very valuable and something that we can go out and start putting into place and use straightaway.” - Steve Walker

“The course has flipped everything I thought I knew about creating financial stability and wealth. Invaluable education thank you.” - Samatha Colwill

Is our property investment seminar right for you?

Our expert property investors have helped everyone from complete beginners to part-time landlords tap into the huge potential of property investment.

No matter what level you’re at, If you’re looking for a way to create additional income, grow your pension pot or build a full time business, then you’d be crazy to miss this.

We put on a wide variety of property investing educational programmes designed to give you all the necessary tools to become a successful property investor.

By attending our seminar, you’ll learn...

● How to select the right property in the right area

● How to create an income now as well as safety for the future

● How to make money through property with very little time and money

● The 7 top property investment criteria and the 7 things to avoid at all costs

You’ll also get access to our “hold nothing back” mastermind group of professional property investors. Best of all, you’ll be able to network with other like-minded, successful property investors who were once in your position.

Professionally recognised and CPD accredited

Our free seminars have now been accredited by the CPD Standards Office, and is recognised as being suitable for the CPD (Continuing Professional Development) requirements of thousands of UK professionals.

And, attending our seminar will equate to 2 ½ hours towards your CPD.

Reserve your FREE spot now (limited availabiliy, maximum two tickets per household)/