Business confidence rebounds following Brexit vote

Business confidence in the South West rose to an 18-month high in the last six months, according to the latest Business in Britain report from Lloyds Bank, based on data gathered after the snap election had been called.

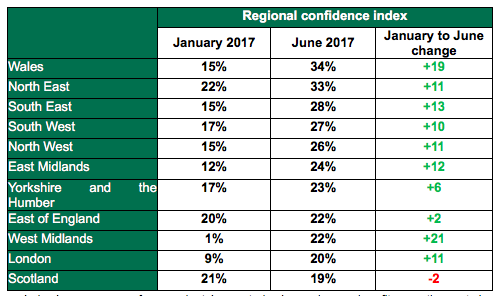

The confidence index – an average of respondents’ expected sales, orders and profits over the next six months – increased to 27 per cent, up from January’s score of 17 per cent and from 10 per cent immediately following the EU referendum vote.

The Business in Britain report, now in its 25th year, gathers the views of more than 1,500 UK companies, predominantly small to medium sized businesses, and tracks the overall “balance” of opinion on a range of important performance and confidence measures, weighing up the percentage of firms that are positive in outlook against those that are negative.

South West outstripped the East Midlands and Yorkshire but falls behind Wales and the North East in terms of confidence.

The confidence index is an average of respondents’ expected sales, orders and profits over the next six months. It calculates the ‘net balance’ - the difference the percentage of firms that are positive in outlook against those that are negative. It can vary between -100 if all firms are negative and 100 if all firms are positive, 0 is neutral.

David Beaumont, regional area director for SME in the South West, Lloyds Bank Commercial Banking said: “Overall confidence has grown significantly since January. And even more so when looking back at our report from September that showed businesses were less confident about expected sales, orders and profits in the wake of the EU referendum.”

Recruitment difficulties emerge

Overall, compared to January, the share of South West firms naming political uncertainty as a potential threat fell slightly (3 points) to 10 per cent while the threat of weaker UK demand remained unchanged on 18 per cent.

The proportion of South West firms that said that they had experienced difficulty in recruiting skilled labour in the last six months, however, increased to 57 per cent, compared with 29 per cent in January; while the share of firms reporting challenges in recruiting unskilled labour also rose slightly to 29 per cent from 21 per cent.

Despite recruiting challenges, the net balance of firms expecting average pay to rise in the next six months fell only slightly to 12 per cent from 14 per cent suggesting companies are taking a cautious approach to hiring and pay.

David Beaumont added: “Despite hurdles in recruiting both skilled and unskilled labour, South West businesses also anticipate sales and profits to rise.

“The outlook for the external environment remains mixed, with details of Britain’s exit from the EU still to come but businesses have been working within those parameters for a while now.

“For the moment, South West businesses are taking this in their stride until there is a clearer sense of what it will mean for them in the short and medium term.”

Weakened outlook for export prospects

South West companies were less positive about export prospects. The net balance of firms in the region expecting higher total exports in the next six months fell 27 points to two per cent from 29 per cent in January. They were most upbeat about export prospects to Middle East (four per cent), followed by US and Canada (two per cent).

Hann-Ju Ho, Senior Economist, Lloyds Bank Commercial Banking, said: “Although the pound’s value is seen as nearer ‘fair value’, currency volatility remains a big concern for some UK businesses that trade internationally. We have already seen some significant currency moves after the general election.”