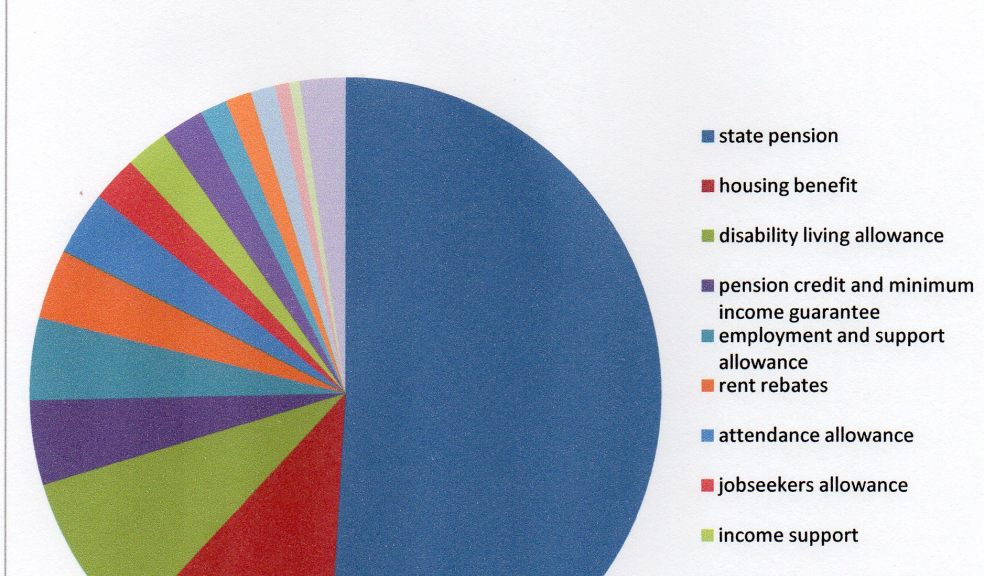

Who gets the most in benefits?

Who really benefits most from welfare spending? A lot of people think that it’s the unemployed. So then, what percentage of welfare spending do you think goes to the unemployed, through Jobseekers Allowance - 50%, 25% or 10%?

The answer, according to the Department for Work and Pensions Annual Report for 2013-14, is just 2.34%. Of an overall annual expenditure of £163 billion, Jobseekers Allowance gets £3.81 billion. However, over half (50.93%) of DWP benefit money goes to those who receive the State Pension - £83.14 billion.

The top fifteen most expensive benefits (£million) are:

state pension - £83,137m, 50.93%

housing benefit - £17,883m,10.96%

disability living allowance - £13,763m, 8.43%

pension credit & minimum income guarantee - £7,042m, 4.31%

employment and support allowance - £6,898m, 4.23%

rent rebates - £5,817m, 3.56%

attendance allowance - £5,360m, 3.28%

jobseekers allowance - £3,812m, 2.34%

income support - £3,583m, 2.20%

employment and support allowance - £3,539m, 2.17%

statutory sick pay and statutory maternity pay - £2,258m, 1.38%

expenditure incurred by the social fund - £2,106m, 1.29%

carers allowance - £2,088m, 1.28%

incapacity benefit - £1,187m, 0.73%

industrial injuries disablement benefit - £901m, 0.55%

All the other benefit expenditure (including TV licences for the over 75s at 0.37%) makes up the remaining 2.36%.

In addition, of course, HM Revenue and Customs pays Child Benefit to families – in 2013-14 this was paid regardless of parental income (although where one parent earned more than £50,000 pa some of this was recovered in income tax). According to the HMRC Annual Report for 2013-14 the total expenditure on Child Benefit payments (including contributions to the Child Trust Fund) was £11.49 billion – three times as much as was spent on Jobseekers Allowance.

HMRC also paid £29.3 billion in Personal Tax Credits (£23bn in Child Tax Credits and £6.3bn in Working Tax Credits) – nearly eight times as much as was paid out as Jobseekers Allowance.

What about other forms of government expenditure? In The Guardian newspaper on 7th October an article appeared with the title ‘Cut benefits? Yes, let’s start with our £85bn corporate welfare handout’. This reported the findings of Kevin Farnsworth, a senior lecturer in social policy at the University of York, who claimed that in 2011-12 the subsidies and grants paid directly to businesses amounted to £14 billion – nearly three times as much as was paid out that year through Jobseekers Allowance. Of course, such expenditure is intended to and may actually succeed in preserving or creating jobs. However, it also subsidises company profits and may lead to rewards for their shareholders - you may already have heard about Amazon having paid less in corporation tax than it had received in government grants. Overall, Farnworth claims that state benefits of various kinds provided for or paid to corporations each year amount to just less than £85 billion a year – more than the total cost of State Pensions.

So the next time you hear those on low incomes, and particularly the unemployed, being blamed for the deficit just tell them where the benefits really go!